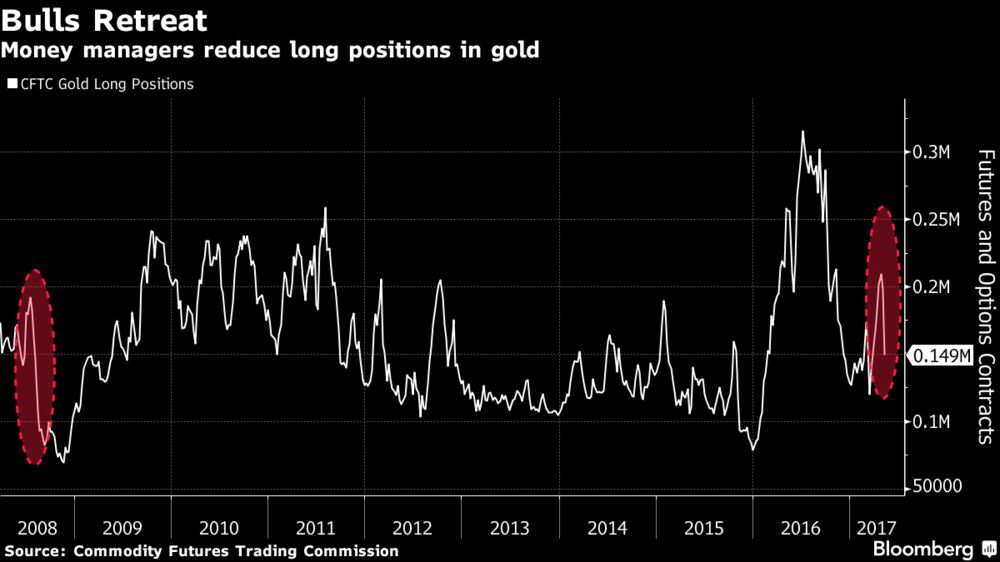

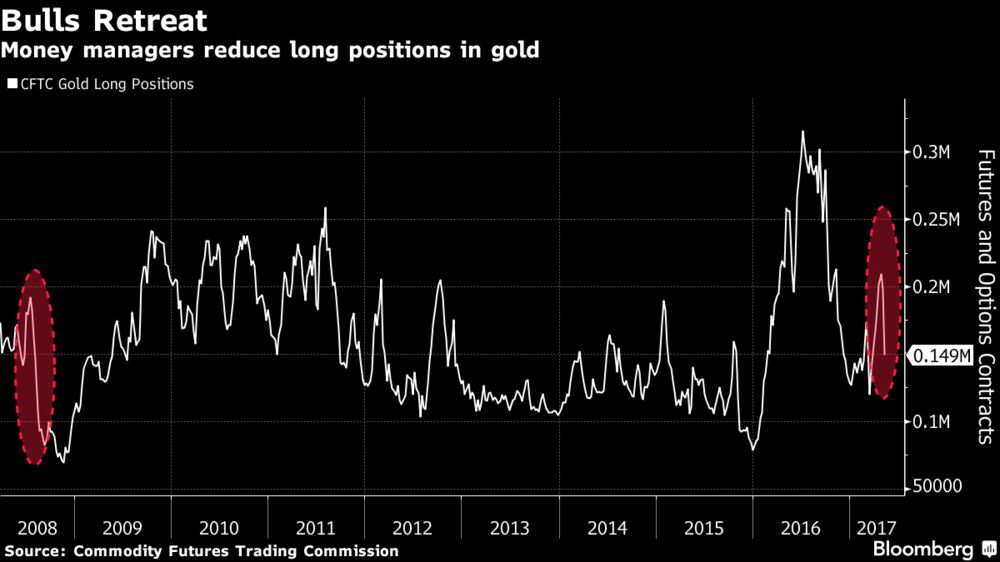

Hedge Funds Are Dumping Gold Bets At Fastest Rate Since 2008

By Susanne Barton

Bloomberg

Bloomberg

May 16, 2017

Expectations for another boost in U.S. interest rates are wearing down gold bulls. Hedge funds and other large speculators cut long positions in bullion futures and options by the most in more than eight years last week. Traders have been exiting as Federal Reserve officials signal higher borrowing costs this year and political uncertainty in Europe eases, reducing demand for gold as a store of value.

Expectations for another boost in U.S. interest rates are wearing down gold bulls. Hedge funds and other large speculators cut long positions in bullion futures and options by the most in more than eight years last week. Traders have been exiting as Federal Reserve officials signal higher borrowing costs this year and political uncertainty in Europe eases, reducing demand for gold as a store of value.

Article Link To Bloomberg:

0 Response to "Hedge Funds Are Dumping Gold Bets At Fastest Rate Since 2008"

Post a Comment