China Bond Connect Has Potential To Shift PBOC Policy

Watch how Chinese government bond yields respond to inflation and growth data going forward given the impact of foreign investor inflows.

By Ben Emons

The Bloomberg View

July 4, 2017

China’s President Xi Jinping’s visit to Hong Kong coincided with the official start of the China Bond Connect program with Hong Kong that gives offshore investors another way to access the mainland’s $10 trillion debt market. Although the link between China’s mainland and offshore bond markets may look ceremonial, for the People’s Bank of China it could help set the stage for a policy shift.

Getting a handle on China’s monetary policy is not an easy task. That’s because the PBOC has multiple objectives: growth, price and financial stability, and controlling the currency. A shift in monetary policy, therefore, represents a change in focus within this multiple objectives strategy. This is what happened in late 2015, when policy shifted from a focus on hiking reserve requirement ratios to managing the yuan. Credit in China rapidly expanded and by the spring of 2017 the PBOC embarked on a campaign to reduce the amount of leverage in the economy and control growth in domestic credit.

The result was a sharp drop in domestic bond issuance that may have sparked efforts by Chinese authorities to quicken the pace of liberalizing the nation’s capital markets. The prospect of foreign money flowing into the domestic Chinese bond and stock markets has the potential to drive PBOC policy toward inflation and GDP targeting.

It will be key to see how Chinese government bond yields respond to inflation and growth data going forward given the impact of foreign investor inflows. Research from the Federal Reserve Bank of New York found that Chinese bond yields are relatively sensitive to changes in manufacturing, producer price and production data. This may become even more so as foreign money becomes a bigger part of the Chinese fixed-income market. When Chinese bond yields respond more to incoming data, financial conditions in China will no longer be determined by just the yuan. In that scenario, the PBOC would have to convey a clear message where it stands on inflation, employment and growth.

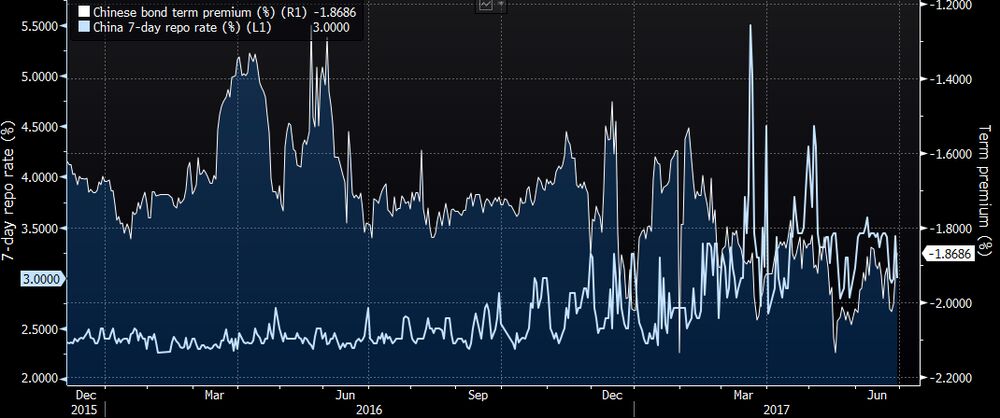

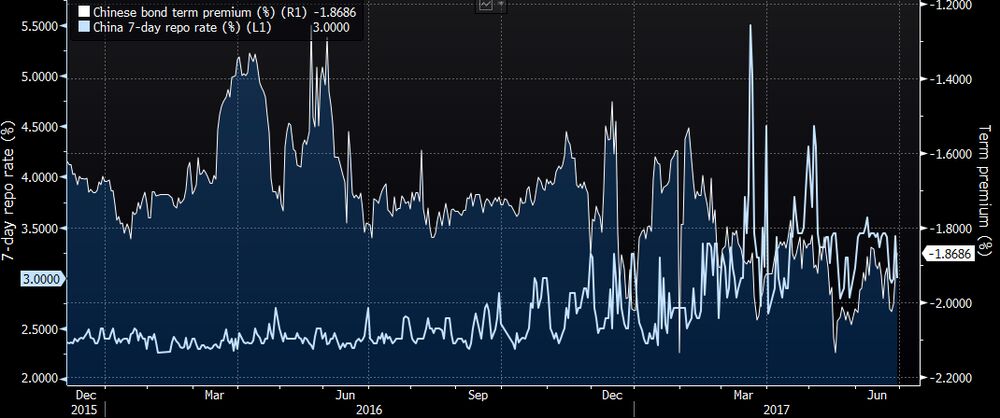

All that would have big implications for China’s government bonds. To understand why, it’s important to know that the securities trade with a very negative term premium, suggesting that investors are not demanding any extra compensation to own longer maturity bonds rather than just holding and rolling over a series of shorter-dated obligations as they come due. The negative term premium in China is almost entirely explained by the correlation with the short term repo rate. This may start to change when money flowing in from foreign investors normalizes the shape of the yield curve, as well as influence expectations for inflation and interest rates. That may entice the PBOC to base policy more strongly on economic fundamentals.

Chinese Term Premium and Repo Rate

Term premium = Chinese 10-year yield – repo rate 1-year forward – China CPI 1-year forecast.

China’s President Xi Jinping’s visit to Hong Kong coincided with the official start of the China Bond Connect program with Hong Kong that gives offshore investors another way to access the mainland’s $10 trillion debt market. Although the link between China’s mainland and offshore bond markets may look ceremonial, for the People’s Bank of China it could help set the stage for a policy shift.

Getting a handle on China’s monetary policy is not an easy task. That’s because the PBOC has multiple objectives: growth, price and financial stability, and controlling the currency. A shift in monetary policy, therefore, represents a change in focus within this multiple objectives strategy. This is what happened in late 2015, when policy shifted from a focus on hiking reserve requirement ratios to managing the yuan. Credit in China rapidly expanded and by the spring of 2017 the PBOC embarked on a campaign to reduce the amount of leverage in the economy and control growth in domestic credit.

The result was a sharp drop in domestic bond issuance that may have sparked efforts by Chinese authorities to quicken the pace of liberalizing the nation’s capital markets. The prospect of foreign money flowing into the domestic Chinese bond and stock markets has the potential to drive PBOC policy toward inflation and GDP targeting.

It will be key to see how Chinese government bond yields respond to inflation and growth data going forward given the impact of foreign investor inflows. Research from the Federal Reserve Bank of New York found that Chinese bond yields are relatively sensitive to changes in manufacturing, producer price and production data. This may become even more so as foreign money becomes a bigger part of the Chinese fixed-income market. When Chinese bond yields respond more to incoming data, financial conditions in China will no longer be determined by just the yuan. In that scenario, the PBOC would have to convey a clear message where it stands on inflation, employment and growth.

All that would have big implications for China’s government bonds. To understand why, it’s important to know that the securities trade with a very negative term premium, suggesting that investors are not demanding any extra compensation to own longer maturity bonds rather than just holding and rolling over a series of shorter-dated obligations as they come due. The negative term premium in China is almost entirely explained by the correlation with the short term repo rate. This may start to change when money flowing in from foreign investors normalizes the shape of the yield curve, as well as influence expectations for inflation and interest rates. That may entice the PBOC to base policy more strongly on economic fundamentals.

Chinese Term Premium and Repo Rate

Term premium = Chinese 10-year yield – repo rate 1-year forward – China CPI 1-year forecast.

Prior to capital controls and the devaluation of the yuan in August 2015, the onshore and offshore yield curves were closely aligned, implying rate and inflation expectations weren't all that influenced by efforts to manage the exchange rate. Foreign capital inflows could offset domestic capital outflows, lessening the need to manipulate short-term interest rates to control the yuan. This would also have an impact on the current gap between the high Chinese onshore rates and those in the U.S., euro zone and Japan. A change in the PBOC's approach to monetary policy prior to the China bond connect going into effect may also help normalize domestic Chinese interest rates to where global rates are trading in yuan terms.

Chinese Forward Rates and Global Forward Hedged to Yuan

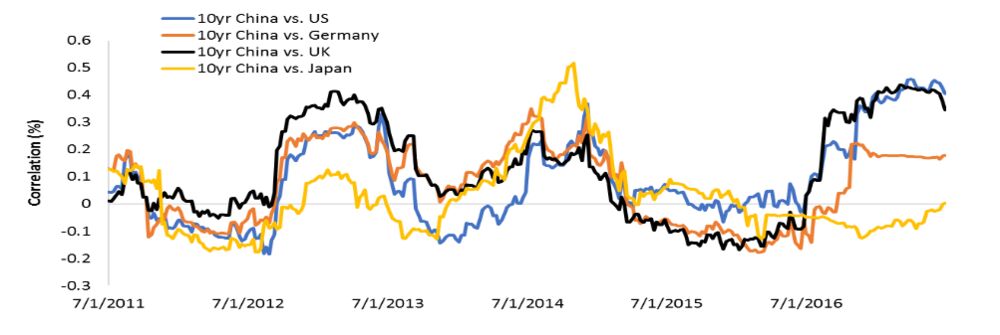

The PBOC setting interest rates based on inflation and growth can also impact the direction of interest rates in other developed sovereign bond markets. That’s because the China bond connect program and potential capital inflows may strengthen the correlation between Chinese and global rates. Correlation is a form of policy coordination so when the PBOC’s policy regime shifts, Chinese interest rates may become another benchmark of influence for global rates. The first sign that such a policy change is perhaps already in the works came after the Federal Reserve hiked rates in mid-June and the PBOC didn’t change the reserve requirement ratio, but instead opted to strengthen the yuan to normalize elevated short-term rates. With MSCI’s decision to include Chinese A shares in its benchmark indexes and the China bond connect program now in effect, PBOC policy is likely to shift further away from proactive currency management towards a focus on economic fundamentals.

Correlation with Chinese Rates

Article Link To The Bloomberg View:

0 Response to "China Bond Connect Has Potential To Shift PBOC Policy"

Post a Comment