Good News Can't Stop Oil Market's Bad Mood As Short-Sellers Rule

Net-long position rises, but mostly due to decline in shorts; ‘Sentiment still seems extremely bearish’: Citigroup’s Evans.

By Alex Nussbaum

Bloomberg

Bloomberg

July 10, 2017

Even good news can do little to dispel the prevailing pessimism in the oil market.

Hedge funds paused a swift increase last month in wagers on declining West Texas Intermediate crude prices. But there was little conviction behind a price rise, as futures shook off a report of declining U.S. stockpiles to finish last week 3.9 percent lower.

“Sentiment still seems extremely bearish," Tim Evans, a Citigroup Global Markets analyst, said in a telephone interview Friday. “We’re responding to every bit of bearish news, but we’re ignoring or seeing a limited reaction to any bullish news."

Even good news can do little to dispel the prevailing pessimism in the oil market.

Hedge funds paused a swift increase last month in wagers on declining West Texas Intermediate crude prices. But there was little conviction behind a price rise, as futures shook off a report of declining U.S. stockpiles to finish last week 3.9 percent lower.

“Sentiment still seems extremely bearish," Tim Evans, a Citigroup Global Markets analyst, said in a telephone interview Friday. “We’re responding to every bit of bearish news, but we’re ignoring or seeing a limited reaction to any bullish news."

Oil futures are down 18 percent this year as investors doubt efforts by the Organization of Petroleum Exporting Countries and its partners to ease a global supply glut. While prices plunged last week after Russia was said to oppose deeper cuts, the market was quick to ignore a decrease in U.S. crude stockpiles to the lowest level since January.

A closer look at the WTI wagers from hedge funds shows that the bears have been a lot more active than the bulls. Bets on a rally haven’t had a weekly increase of more than 5 percent for more than two months. Meanwhile, sharp moves in bets on a decline have set the tone.

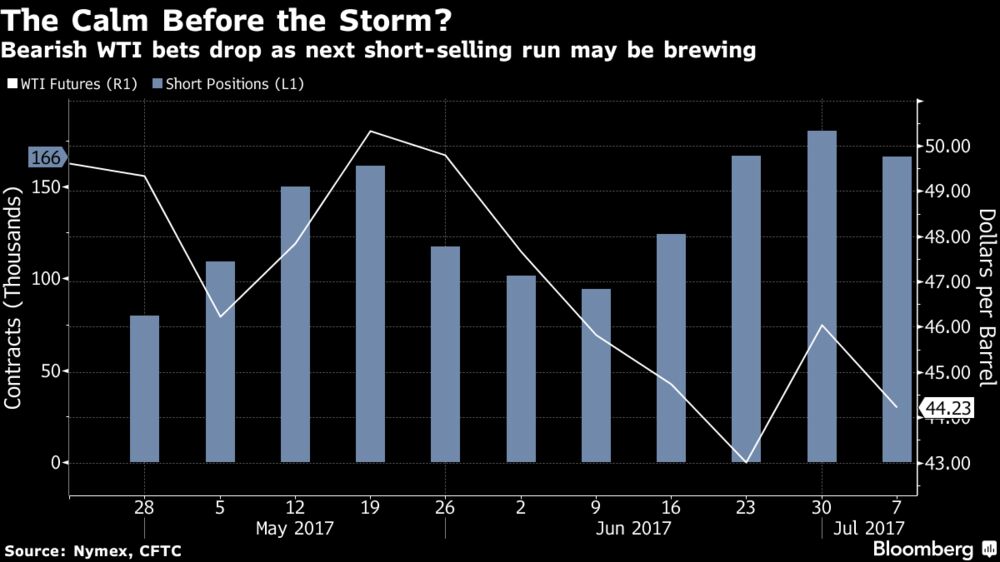

Money managers’ net-long position on WTI rose 12 percent to 149,951 futures and options as of July 3, mainly because short-sellers retreated, according to a weekly U.S. Commodity Futures Trading Commission report released Friday. While longs rose by less than 1 percent to 316,447 contracts, shorts fell 7.8 percent to 166,496. In the previous three weeks shorts almost doubled, reaching their highest point in almost a year.

Short-Covering

The latest numbers suggest that the gains in oil prices before last week’s slump were largely a short-covering rally, in which those betting on a decline take advantage of low prices to buy securities they had borrowed and sold when prices were higher, according to Citigroup’s Evans.

“You didn’t see a lot of long accumulation," he said. “It may be an indication that we reached a level where those traders are just willing to take profits."

Investors also gave gasoline and diesel a break, reducing their net-short positions on both, the CFTC report showed.

WTI fell 2.8 percent on Friday to settle at $44.23 a barrel in New York. Brent, the global benchmark, dropped 2.9 percent to $46.71.

Adding to the gloom, Saudi output increased in June by the most in almost a year, according to a Bloomberg survey. In the U.S., shale drillers keep adding rigs, and production has risen for most of the year. Worries about a global supply glut have kept futures below $50 a barrel for the past six weeks.

Even hedge fund manager Andy Hall, who’s taken an optimistic tone on oil for months, capitulated to the bearish mood. In a recent investor letter, the oil market legend said the global crude market has “materially worsened" and prices may be stuck around $50 a barrel or below.

Summer Boost

The more bullish tilt in hedge fund wagers wasn’t all about short-covering, though, said Michael Lynch, president of Strategic Energy & Economic Research in Winchester, Massachusetts. The summer driving season in the U.S. is moving into high gear, which should increase demand for oil, Lynch said in a telephone interview. Hurricane season in the Gulf of Mexico is also looming and political tensions over North Korea and Qatar may also have convinced speculators that prices could rebound.

“Although the fundamentals still aren’t great, most of the possible news is likely to be bullish," Lynch said.

Evans also saw the potential for a turnaround. “The most common cycle is that major rallies start with short-covering from an oversold condition," he said. “That’s an early stage in a bull market."

But for now, the bears seem to be winning.

“Until we start to really eat into the inventory numbers, until production slows and looks like demand is catching up, if not outstripping supply growth, we’re going to keep seeing this negative bias," said Rob Haworth, a senior investment strategist at U.S. Bank Wealth Management in Seattle, which oversees $142 billion in assets.

Article Link To Bloomberg:

0 Response to "Good News Can't Stop Oil Market's Bad Mood As Short-Sellers Rule"

Post a Comment