U.S. Strategic Oil Reserves Shrink As Shale Offers Supply Buffer

Drawdowns continues as White House pledges to sell more; Rising domestic output to offset need for a flush SPR.

By Sheela Tobben

Bloomberg

Bloomberg

July 6, 2017

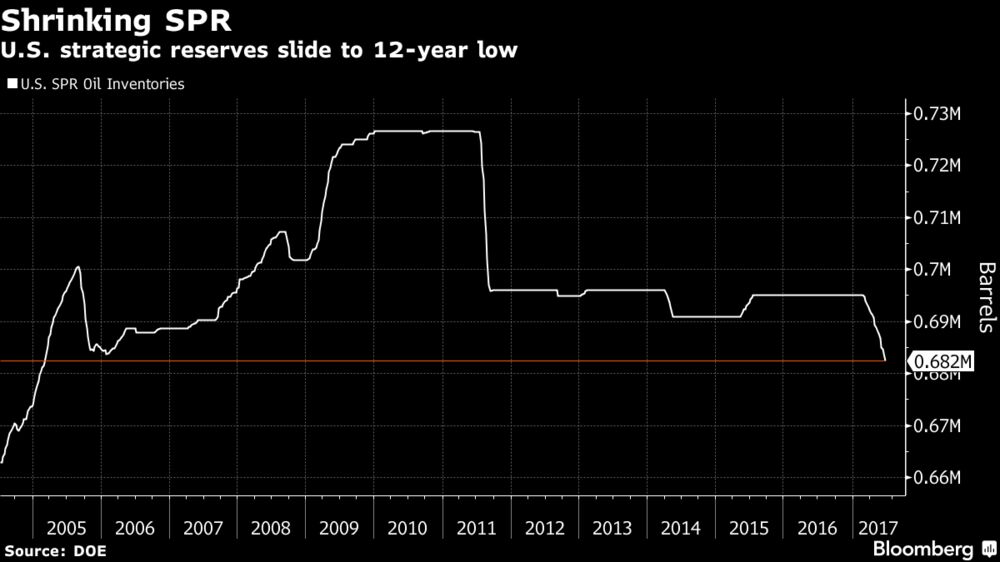

U.S. strategic crude stockpiles have dropped to the lowest level in more than 12 years as the shale boom reduces the nation’s need for an emergency buffer against shortages.

Inventories declined by about 13 million barrels over 17 consecutive weeks as the Energy Department delivered supplies it sold in recent months. That brought stocks down to 682 million as of June 30. In two sales held in January and February, the agency sold almost 17 million barrels of crude from its salt caverns in Texas and Louisiana to companies including Chinese state-owned PetroChina Co. Ltd.

The SPR sales have less impact than in the past because the U.S. doesn’t need that much in storage, said Vikas Dwivedi, senior analyst at Macquarie Capital (USA) Inc. "You only need 60 days of your net import of crude and products in the emergency stockpiles."

U.S. strategic crude stockpiles have dropped to the lowest level in more than 12 years as the shale boom reduces the nation’s need for an emergency buffer against shortages.

Inventories declined by about 13 million barrels over 17 consecutive weeks as the Energy Department delivered supplies it sold in recent months. That brought stocks down to 682 million as of June 30. In two sales held in January and February, the agency sold almost 17 million barrels of crude from its salt caverns in Texas and Louisiana to companies including Chinese state-owned PetroChina Co. Ltd.

The SPR sales have less impact than in the past because the U.S. doesn’t need that much in storage, said Vikas Dwivedi, senior analyst at Macquarie Capital (USA) Inc. "You only need 60 days of your net import of crude and products in the emergency stockpiles."

Crude oil and refined product net imports stood at 4.23 million barrels a day for the week ended June 23, down from a record high of 14.4 million in November 2005. "Given the fact that we don’t net import that much any more, we only really need 300 million barrels," of SPR crude, Dwivedi said in a phone interview from Houston.

The U.S. set up the reserve in the aftermath of an oil embargo in 1973-1974, when several Middle East states cut off oil supplies to the U.S. Construction of the first surface facilities began in June 1977.

These drawdowns won’t end any time soon. The Trump administration has plans to sell another 270 million barrels of crude from the SPR over the next decade to help reduce the country’s debts. This is over and above the 190 million-barrel sale planned for 2018-2025.

"As soon as Trump got elected, we knew they were not going to be able to finance their plans for tax cuts," said Dwivedi. "So anything that looks like a piggy bank will get broken."

Storm Buffer

The reserve has acted as a buffer against natural disasters along the U.S. Gulf Coast, particularly hurricanes. In September 2005, President George W. Bush authorized the emergency sale of 30 million barrels of crude from the SPR after Hurricane Katrina swept through the Gulf of Mexico, causing massive damage to oil production facilities. Three years later, Hurricanes Gustav and Ike disrupted crude supply to several refineries along the Gulf Coast, prompting the release of 5.39 million barrels of SPR crude. These on-loan barrels were repaid in 2009.

The country’s emergency needs can now be covered with domestic crude supply, which is about 80 percent higher than a decade ago, thanks to developments in horizontal drilling and fracking that boosted production from areas that had been too expensive to tap. Domestic output reached 9.35 million barrels a day last month, the highest since August 2015, and is forecast to increase to above 10 million a day early next year.

The growth in U.S. production has been spread out all over the country, and not concentrated in areas like the Gulf of Mexico, where fields are prone to weather hazards, Dwivedi said. "We won’t knock off producing shale wells because of a storm."

Article Link To Bloomberg:

0 Response to "U.S. Strategic Oil Reserves Shrink As Shale Offers Supply Buffer"

Post a Comment