Fed Balance Sheet Policy May Amount To More Easing

The structure of the bond market these days is such that there's a good chance financial conditions will continue to loosen.

The Bloomberg View

August 3, 2017

The Federal Reserve has raised interest rates four times since December 2015 and financial conditions have eased. That is the opposite of what Fed policy makers had hoped would happen as they tightened monetary policy. Now, central bankers are talking about taking the next step and shrinking the Fed's $4.5 trillion balance sheet by not reinvesting the proceeds of maturing bonds into new securities.

Surely that will cause long-term yields to rise and financial conditions to finally tighten, right? Maybe not. The structure of the bond market these days is such that there's a good chance conditions will continue to loosen, further underpinning demand for riskier assets ranging from equities to high-yield debt to emerging-market currencies.

To understand why, first consider that institutions that needed very high quality securities to comply with new regulations designed to make the financial system safer have been somewhat crowded out by the Fed's purchases. They will now have the opportunity to buy Treasuries and the resulting demand should help contain long-term yields. At the same time, officials such as New York Fed President William Dudley have hinted there will be a pause in rate hikes during the initial stages of balance-sheet normalization, which should also help support the market.

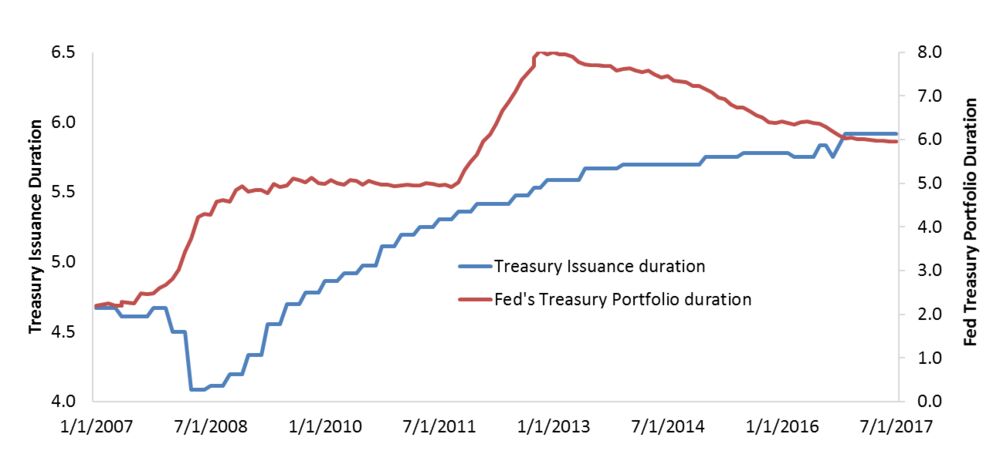

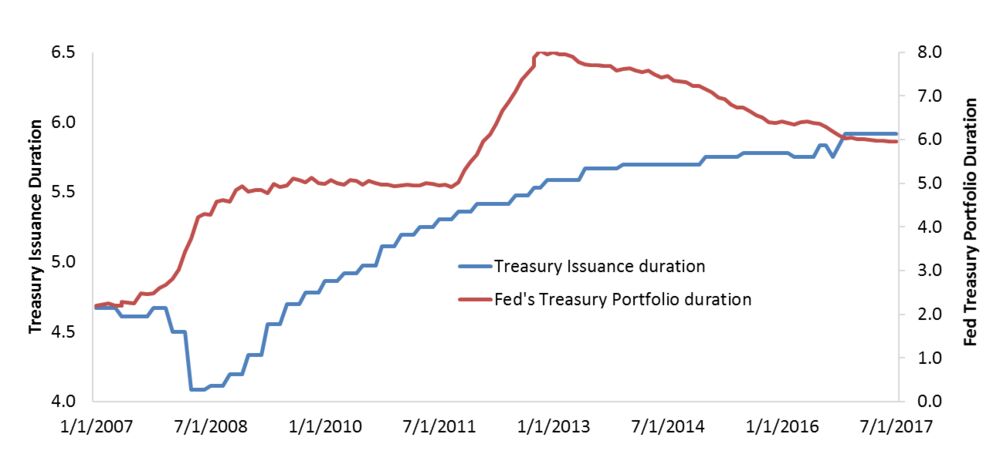

Then there are more technical reasons to believe that financial conditions will continue to be relatively loose. Some strategists and investors are under the impression that in the absence of Fed purchases, the Treasury Department will have to increase issuance of longer-term debt if it wants to meet its goal of raising the average maturities. The assumed result from all this new debt would be a rise in longer-term bond yields. The problem with that assumption is that the Fed's balance sheet assets and Treasury issuance have currently about the same amount of duration risk. Longer-term yields could therefore stay range bound while the Fed's balance sheet normalization plan allows for a pause in rate hikes so the economy can adjust. The combination of these two factors is a de facto "easing" policy.

Duration Risk

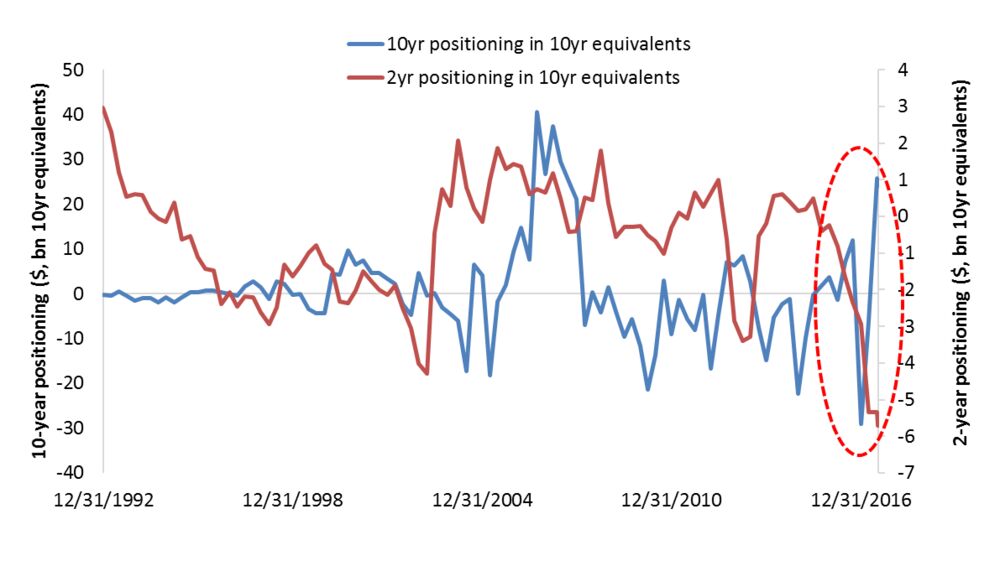

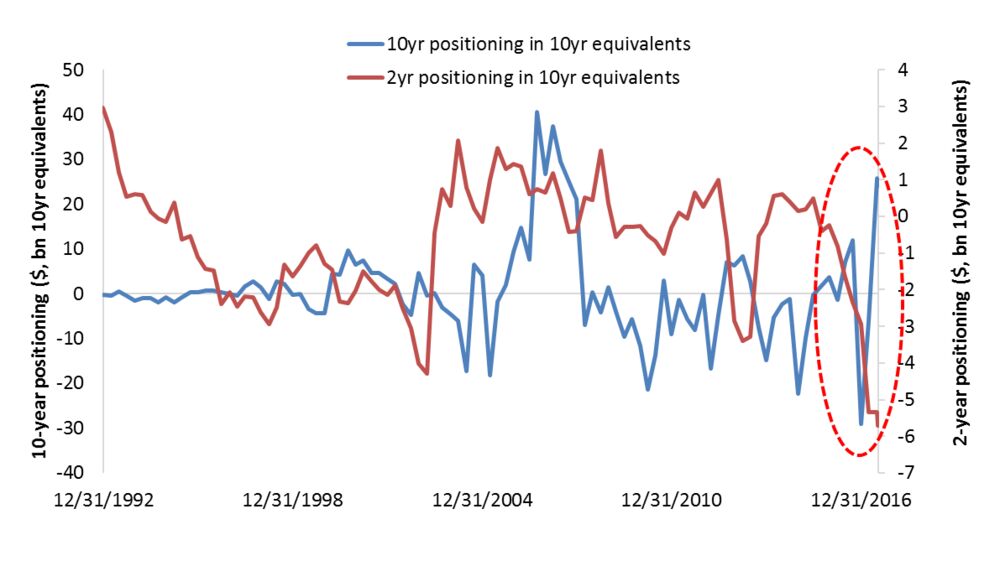

Then consider that positioning in Treasury futures is dominated by two extreme views: bets against short-term Treasuries on the notion that Fed rate increases will continue in a gradual fashion and bets on gains in longer-term Treasuries on the notion that balance sheet normalization won't cause a major disruption in that part of the market. It's not hard to imagine that short-term notes could benefit as bearish positions are unwound, creating inherent demand. This potential shift in positioning would put pressure on the yield curve to steepen, reversing the dominant flattening trend that has been has been in place since late 2013.

10-Year Equivalents Of Positioning

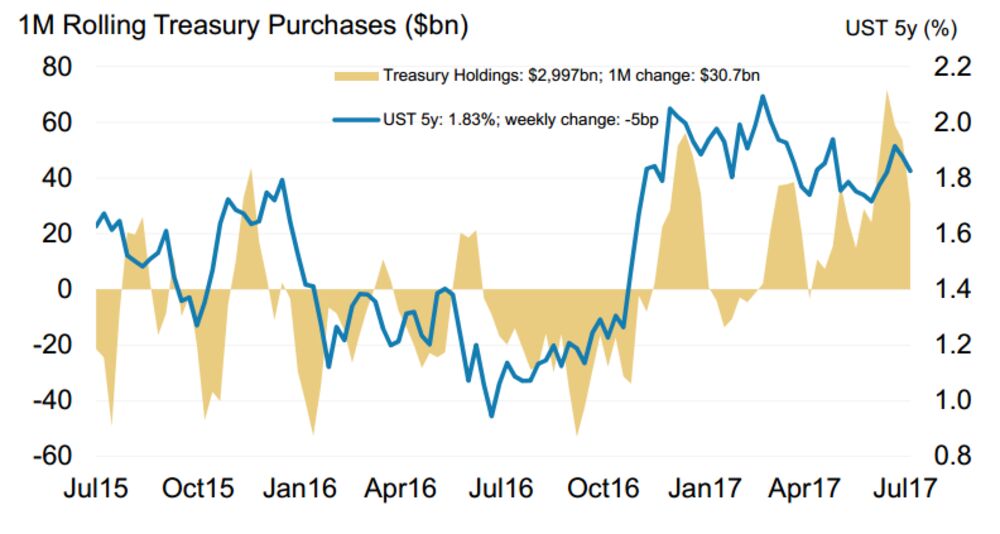

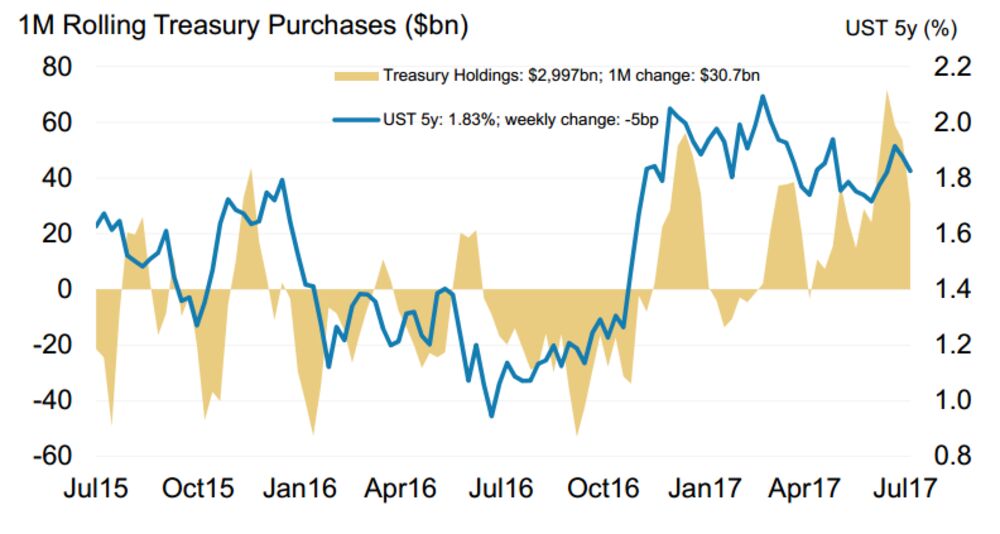

A steeper yield curve would only serve to boost demand from foreign central banks, helping to contain any rise in yields. Recent Treasury Department debt auctions have seen an increase in bid-to-cover ratios for two- and five-year Treasuries and more participation by "indirect" bidders, which are generally thought to be foreign official institutions. As a result, foreign central bank holdings of five-year Treasuries have turned positive since the start of 2017 on a rolling monthly basis.

Central Bank Sweet Spot In Treasuries

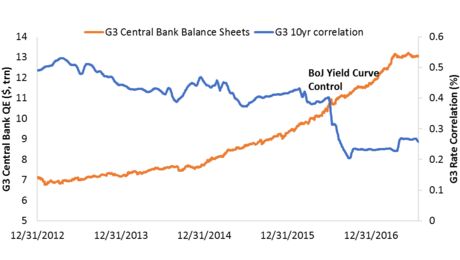

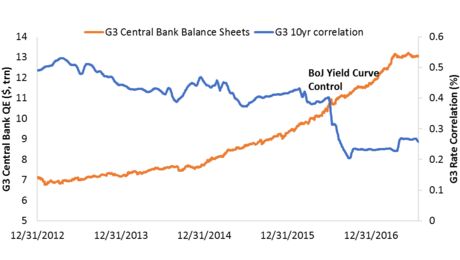

Balance sheet normalization may also cause correlations among global bond yields to become even less so. As mentioned earlier, long-term interest rates may stay in a range because of limited risk stemming from a shrinking balance sheet. That may contain interest rate volatility and because of lack of movement, correlation could fall. This is a different situation than during the "taper tantrum" in 2013, when yield correlations were very high, and why a sell-off in Treasuries at the time spilled over into other bond markets around the world. Correlations have since fallen as central bank balance sheets expanded. It can even be said that the Bank of Japan's tight control over that nation's yield curve is contributing to the low volatility in bond markets worldwide.

QE And Yield Correlation

Taking all these factors into consideration, it's easy to see how the Fed's balance sheet normalization plan might not be as disruptive as some suggest. The big risk is that financial conditions loosen to an extreme and are followed by a broad stock market correction. Until that happens, though, expect Fed policy tightening to behave more like an easing.

Yield Curve And Financial Conditions

The Federal Reserve has raised interest rates four times since December 2015 and financial conditions have eased. That is the opposite of what Fed policy makers had hoped would happen as they tightened monetary policy. Now, central bankers are talking about taking the next step and shrinking the Fed's $4.5 trillion balance sheet by not reinvesting the proceeds of maturing bonds into new securities.

Surely that will cause long-term yields to rise and financial conditions to finally tighten, right? Maybe not. The structure of the bond market these days is such that there's a good chance conditions will continue to loosen, further underpinning demand for riskier assets ranging from equities to high-yield debt to emerging-market currencies.

To understand why, first consider that institutions that needed very high quality securities to comply with new regulations designed to make the financial system safer have been somewhat crowded out by the Fed's purchases. They will now have the opportunity to buy Treasuries and the resulting demand should help contain long-term yields. At the same time, officials such as New York Fed President William Dudley have hinted there will be a pause in rate hikes during the initial stages of balance-sheet normalization, which should also help support the market.

Then there are more technical reasons to believe that financial conditions will continue to be relatively loose. Some strategists and investors are under the impression that in the absence of Fed purchases, the Treasury Department will have to increase issuance of longer-term debt if it wants to meet its goal of raising the average maturities. The assumed result from all this new debt would be a rise in longer-term bond yields. The problem with that assumption is that the Fed's balance sheet assets and Treasury issuance have currently about the same amount of duration risk. Longer-term yields could therefore stay range bound while the Fed's balance sheet normalization plan allows for a pause in rate hikes so the economy can adjust. The combination of these two factors is a de facto "easing" policy.

Duration Risk

Then consider that positioning in Treasury futures is dominated by two extreme views: bets against short-term Treasuries on the notion that Fed rate increases will continue in a gradual fashion and bets on gains in longer-term Treasuries on the notion that balance sheet normalization won't cause a major disruption in that part of the market. It's not hard to imagine that short-term notes could benefit as bearish positions are unwound, creating inherent demand. This potential shift in positioning would put pressure on the yield curve to steepen, reversing the dominant flattening trend that has been has been in place since late 2013.

10-Year Equivalents Of Positioning

A steeper yield curve would only serve to boost demand from foreign central banks, helping to contain any rise in yields. Recent Treasury Department debt auctions have seen an increase in bid-to-cover ratios for two- and five-year Treasuries and more participation by "indirect" bidders, which are generally thought to be foreign official institutions. As a result, foreign central bank holdings of five-year Treasuries have turned positive since the start of 2017 on a rolling monthly basis.

Central Bank Sweet Spot In Treasuries

Balance sheet normalization may also cause correlations among global bond yields to become even less so. As mentioned earlier, long-term interest rates may stay in a range because of limited risk stemming from a shrinking balance sheet. That may contain interest rate volatility and because of lack of movement, correlation could fall. This is a different situation than during the "taper tantrum" in 2013, when yield correlations were very high, and why a sell-off in Treasuries at the time spilled over into other bond markets around the world. Correlations have since fallen as central bank balance sheets expanded. It can even be said that the Bank of Japan's tight control over that nation's yield curve is contributing to the low volatility in bond markets worldwide.

QE And Yield Correlation

Taking all these factors into consideration, it's easy to see how the Fed's balance sheet normalization plan might not be as disruptive as some suggest. The big risk is that financial conditions loosen to an extreme and are followed by a broad stock market correction. Until that happens, though, expect Fed policy tightening to behave more like an easing.

Yield Curve And Financial Conditions

Article Link To The Bloomberg View:

0 Response to "Fed Balance Sheet Policy May Amount To More Easing"

Post a Comment