The Real Reason Car Sales Are Falling

Vehicles haven’t been hitting the junkyard quick enough to maintain what had been a record pace.

By Kyle Stock

Bloomberg

August 3, 2017

August 3, 2017

Sure, there are aberrations, but given those numbers and today’s economy—with a strong labor market, relatively affordable financing, and cheap gas—it’s reasonable to ask why, then, are car sales tanking?

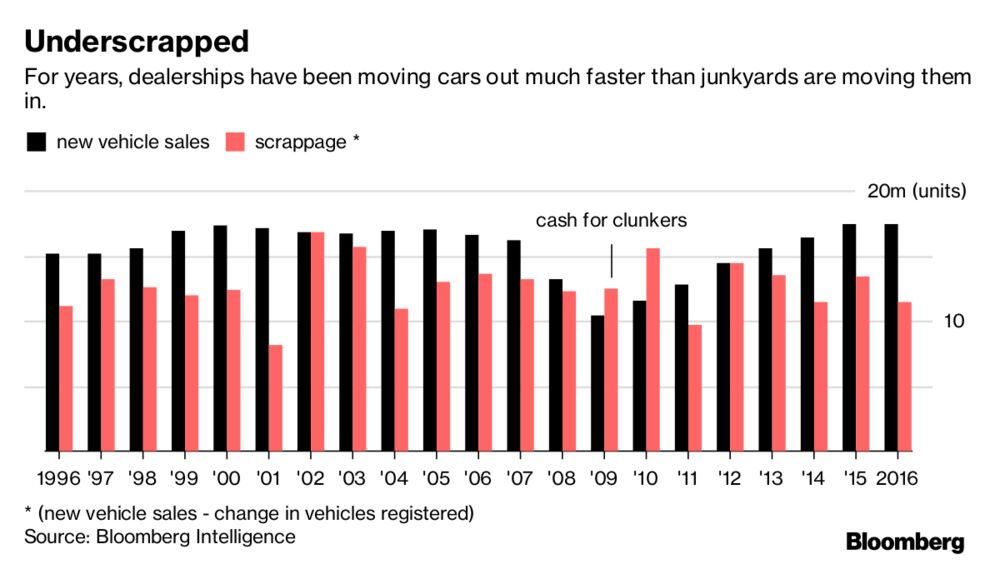

The only real wild card in the U.S. car market is the replacement rate, which is to say how often cars and trucks make their way to the junkyard. This is perhaps where auto executives should have seen the slowdown coming. In the past two decades, about 13 million vehicles were dropping out of the U.S. fleet every year, far less than the number of new vehicles sold over the past five years. Customers keen to upgrade kept the market running hot for awhile, but that imbalance finally caught up with automakers. As more vehicles stayed in the driveway, fewer came off the lot.

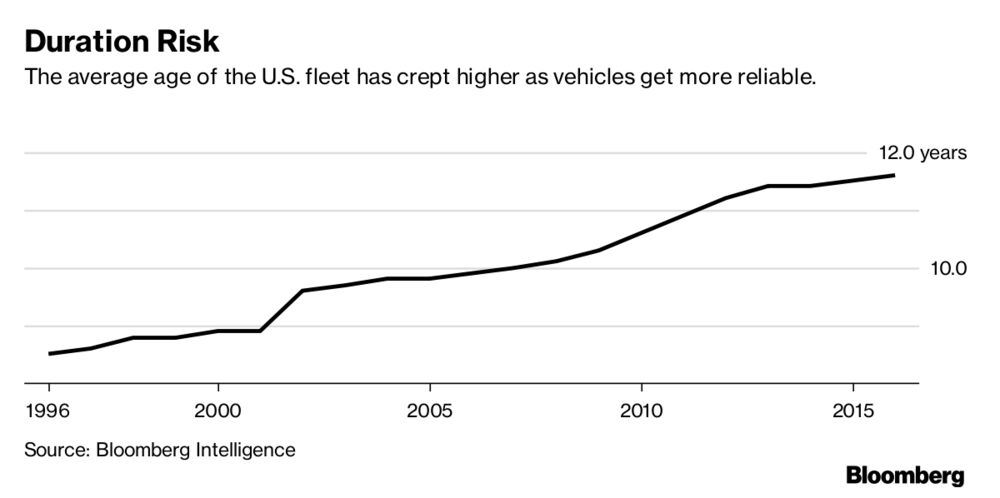

Americans still tend to own slightly more than one vehicle apiece, but they are keeping those vehicles longer. The average car or truck on U.S. roads today was made in 2005. They’re still on the road because, well, they’re still on the road. Vehicles made in the past 15 to 20 years are vastly more reliable than their predecessors. The U.S. auto industry is in a pickle, in part, because it did too good of a job.

Meanwhile, the accelerating pace of innovation may be making things even worse. With each advancement in electric powertrains and autonomous driving, it’s easier to envision a game-changing machine, the prospect of which shifts some would-be buyers into the wait-and-see category. Why buy a new car now when the car of your dreams is just over the horizon?

A 2017 Toyota Camry, for example, still isn’t vastly different from the 2007 iteration. Someone driving the early model, however, may figure a 2020 Camry will drive itself and zip around on electrons. This is one of the main reasons why the lease rate in the U.S. has crept up to almost one-third, according to Tynan. Customers worried about a machine quickly becoming obsolete are choosing a three-year loaner rather than an outright purchase.

Car executives, of course, know this better than anyone, and no one in the C-suites of MoTown was probably surprised by the latest sales numbers. It’s just that braking is no fun. Heeding to a slowing market means handing out pink slips. And then there is swagger to account for. The right mix of vehicles—a hot new SUV, or an electric dream pod that appears in the desert—could be just the thing to buck a cyclical downturn.

“The way the industry has always worked, you get all you can get while you can,” Tynan said. “When the industry shifts gears, then you deal with it.”

Companies like Ford and GM have many levers to pull to avoid a disaster—namely, a mix of lowering production and raising incentives to lure drivers back to the dealership.

“They’re going to find a way to deal with it, until they get kind of right-sized on production,” Tynan said. “Basically, it’s a question of how soft do you want to land?” In the meantime, it’s a great time to get a deal on a new car.

Article Link To Bloomberg:

0 Response to "The Real Reason Car Sales Are Falling"

Post a Comment